Boosting Selling in Retail and F&B Restaurant on 2021

The COVID-19 pandemic has raged on for almost a year and continues to create significant challenges for a variety of business sectors and also in our daily life. As countries around the world struggle with crushing multiples waves of infection, new lockdowns, and slow vaccine distribution, changes in the way we work, live and shop has become embedded. The long-term effects might be most deep and lasting for consumer-facing companies, which are on the front lines in dealing with the upheaval. The pandemic also impacting in the economy and the customer behavior in spending their money, this empirical statement strengthens with the survey result from BPS (Badan Pusat Statistik) Indonesia, Indonesia Gross Production Brutto is declining -2.2 in 2020, that is the impact of the pandemic. Territory restriction, travel restriction, limitation of public facilities hours, all those hit the economic transaction Internationally and also in Indonesia. The worst impact also many companies have to execute massive dismissal to survive in 2019. Unemployment and underemployment are significantly higher than before the crisis. The National Bureau of Statistics (Badan Pusat Statistik/BPS) finds that 5.1 million people (2.5 percent of the working-age population) have lost their jobs and 24 million individuals (11.8 percent of the working-age population) are working reduced hours due to COVID-19, with substantially larger impacts in urban areas and among men. This situation makes the citizen have to spend their money wiser, to buy only necessary things, they specifically on food, health products. Even the wealthy cohort also have to hold their expenses on the luxurious things due to the uncertainty in this pandemic situation, it can be seen in the customer price index that declining from 2.8 in 2019 to 2.0 in 2020.

As the vaccine is found and being distributing in Indonesia, the Indonesian government expecting our GDP and CPI will be inclining in the 2021 and 2022, which the GDP expected to be increased to 4.4 points, and the customer Price Index expected to be increased to 2.3 points. yet the uncertainty remains high due to the vaccine distribution and impact might takes some time.

Despite the decline of Indonesia GDP and CPI, customer spending behaviours in Indonesia can be considered prospecting, as it can be seen on the spending distribution survey result from BPS Indonesia 2018, the middle class in the urban area of Indonesia is inclining significantly from 46,34 % in 2010 with the classification middle-middle, and upper-middle, to 67,32% in 2018 with the same classification. Moreover in 2018 appear new population in the upper class 6,96%, which there is not found in the BPS result in 2010. The poor and even though this is the survey result on 2018, it is still used as a prediction on the potential buying of Indonesia population as a target for business 2021, with the consideration additional almost 1% of the poor population due to the pandemic impact.

Based on the BPS statistic result the business in Indonesia still has the potential opportunity to recover and inclining in 2021 and 2022. It means the company needs to readjust its focus, strategies, and methods to be able to reach the biggest population class in Indonesia, they are middle-middle, and middle-upper class, we still have hope. To achieve that we need to know the customer expectation and market macro trends in 2021.

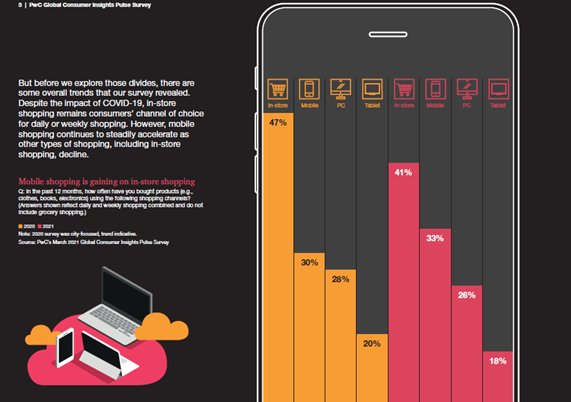

Based on PWC global consumer behavior pulse survey 2021, we found out several results about customers’ expectation, one of them is the result that showing various channels that being used by the customer in 2020 and 2021, and the most channels being used globally still physically store or, people still remind to choose shopping in the stores with the percentage 47% in 2020 and 41% in 2021. The trend is decreasing along with the customer familiarization with online channel shops.

The same research also found out customers’ global macro trends in 2021:

- The store of the future: The store of the future will be omnichannel and experience-rich, and will fuse the physical and digital worlds.

- Brand relevance: Socially conscious consumerism will continue to grow as people seek brands that they trust and that align with their values.

- The digital supply chain: The supply chain of the future will operate with near autonomy, making ‘smart’ decisions to self-regulate. This expectation is also required to accommodate the customers’ needs to frictionless and health concerns. Digitalization and end-to-end visibility will be the key to an evolving supply chain.

- The future of food: Consumer demand for healthier products, along with expectations for greater transparency and sustainability in the food value chain, will increase.

- ESG ascendance: Pressure from regulators and boardrooms to focus on ESG will continue to intensify.

We are going to highlight the store of future, according to the result of the PWC survey 2021. The store will have a lot of various channels to sell their product, could be physical stores, online stores thought out website platform, Instagram, Facebook, WhatsApp business, TikTok and many others channels that might come in the futures. Moreover, the customer experience will one of the crucial things that have to be delivered by the company whether through in store shops and also online shops.

What are the experiences that customers expect?

- Physical stores, customers expect high concern of health and safety, it can be facilitated by providing technology that helps frictionless during the transaction, for instance for giving information about the product to customers, payment with less-physical contact, both can be done through scanning barcode, or browsing specific link using they own handphone that leads to the product information and the payment.

- Experiential retail: Successful brick-and-mortar retailers of the future will need to give consumers a purpose-driven reason to walk through the doors and will have to find ways to enrich the customer experience using technology.

- Next-level automation: Automation will continue to reshape the retail experience as inventory-checking robots, smart shopping carts, and drone delivery move from the conceptual to the common.

- Environmental, Social, and Governance concern, customers most willing to pay a price premium for healthier options, local produce, and sustainable packaging, regardless of whether they’re shopping online or in-store.

These customers’ expectations need to be addressed and executed consistently in the selling. On stores/Restaurant the expectation of health and safety can be delivered, by providing and offering hand sanitizer in the first step of selling. Next steps the details of product knowledge also can be put online so the customer can read the information by their cell phone, before asking the sales staff. This is to accommodate the frictionless during the transaction. Yet still, in-store shopping, sales staff always have to initiatively to approach the customers and engage to the customers during the transaction, not only rely on the online product knowledge that the can browse online. The staff needs to handling customers’ questions, customers’ objections and closing the sales. Another step that needs also to be applied is to make sure that every stores’ employees, restaurant/fast food Restaurant staff doing health protocol during their shift in the stores as well as during their break time because we have to keep in our mind that our customers might see what we do outside our stores/restaurant during our break time. Our customers might walk behind us or beside us and they can see how serious we are doing the health protocols. For restaurant or fast food, make sure you always do the health protocol in cleaning customers’ table, chair, every time customers finish their meal make sure you clean up the table along with disinfectant/any products that reference in WHO health protocol, so that customers that might just arrive or sitting around that table, can see how your staff do the healthy protocol consistently. The consistency of doing health protocol of Covid 19 need to embrace by all stores’ employees, all the restaurant/fast food staff.

In addition, to deliver the experience to the customer put your signature when you do service to the customers, prepare everything before you opening the stores/Restaurant, make sure the stores/Restaurant is clean, the product all are cleaned, run the music that related to your brands, use specific fragrances to elevate customers mood. Overall provide the perfect ambiance that can give convenience, healthy, and safe to our customers. Another technical step to boost selling is by analyzing customers’ needs correctly so that we can offer the product that they need or they desired, it can be done by mastering selling skills and mastering product knowledge. Those two skills are always required whether you are selling in stores or online.

The conclusion is, to boost your sales during the pandemic, you need to refocus your business strategy and tactic to accommodate customers’ expectation on 4 major expectations on the future store, they are health and safety concern, give more personal experience that makes them have the reason to come back to your stores, use technology to automize the operation works for efficiency and to give shopping frictionless experience to the customers, provide good quality products, healthy option products, moreover provide local products as an option, and provide a sustainable packaging. Last but not least, another important action needs to be done, you need to equip your Sales Staff/Restaurant Staff with proper training in selling skills and product knowledge, schedule and arrange practice session after training regular so that they embrace and embody the selling skills. All of those will elevate your staff selling skills and boost your selling during this pandemic.