Coronacrisis (Balancing Acts in Turbulence Time)

More than a year has gone by since Corona was declared pandemic status. Around the declaration dates, market and economic indicators gone haywire, with “Black Swan”-like events took place, some of them are:

• S&P 500 stock index sell-off in 22 days is the fastest recorded in history

• First time negative settlement of Crude WTI oil price in history

• Highest US unemployment figure since World War II

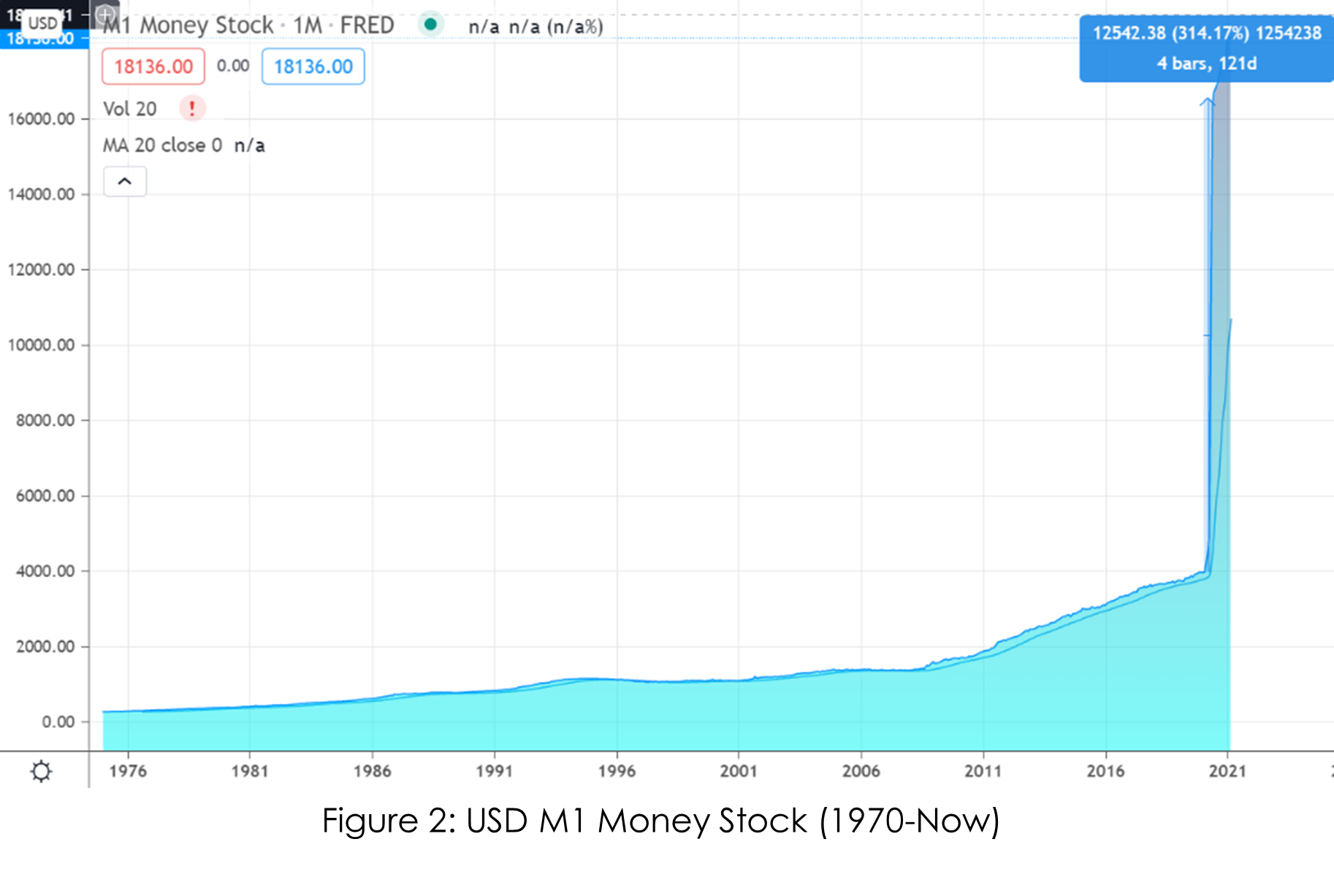

The sharp decline (ca. 30%) in United States S&P 500 stock index, along with extreme movements in other asset classes and severe economic figures publication, triggered US Federal Reserve (The Fed) to act quickly. Remembering 2008 global financial crisis, The Fed was fast with their emergency monetary policy. Just within months, the United States printed money in a pace never since before: a 300% increase in M1 money supply just within months. This is a magnitude that’s never seen before in any major central bank history, in both relative nor absolute values. This is understandable as working vaccine mass-production was definitely out of horizon back then. With such massive support, just within months, asset prices started to rebound from March 2020 lows.

A year later, in Q1-2021, countries all over the world have started their mass vaccination program. As public confidence grew, market started to price in economic growth. Government bonds were sold, pushing implied risk-free rates higher in a fast pace. On the other side of the equation, commodity prices also climbing, which is understandable given such amount of new money supply: money dilution. Stock market started to get nervous, as this implies market would like to see higher equity return, given equity risk premium expectation from the market. Any commentary implying rate-hikes would increase volatility, it reminded some people to the “Tap-On, Tap-Off” Taper Tantrum, taking place in around 2013.

Meanwhile, from non-financial industry aspect, we can see soaring commodity prices, pushing consumer prices further up. It doesn’t stop there; residential property assets are also on the rise. With local example in the Netherlands, some prominent political figures are calling for the creation of public housing ministry, to tame the rising house prices in midst of housing shortage in the country. A trend that is also observable in other European countries and, very likely, also outside European Union. While Covid-19 second waves in other countries are seriously taking place right now (e.g. India, Brazil), developed countries are already expecting in economic recoveries to take place next year (2022), at least informally.

Given such progress in the last one year, in the future, we might see a very different post Covid-19 world. The question is: are you ready? In turbulence time, it is imperative for CFO domain to support company’s well-beings, especially by providing financial stability through reducing financial volatility. Our next 1-day training in 12 July 2021, “Derivatives for Treasury Operations”, is designed to give general introduction over the use of financial derivatives for companies to hedge their exposures to the market, direct and hidden. Training audience will be presented with general derivative products that can help hedging volatilities in their books, especially in turbulent times as Coronacrisis.

This 6-hours long program will also show some cases and scenarios, in which training audience will be introduced with available tools for them, to better navigate into the future.